As the US-China trade conflict is about to enter its third year, Washington has little to show for it. A lasting settlement does not look within imminent reach. Washington’s ‘asks’ are known and include the reduction of the bilateral trade deficit, greater access to Chinese markets for US exporters and investors, greater protection of intellectual property rights as well as restrictions on the activities of Chinese state-owned enterprises, including their role in government-sponsored industrial policies. What is less clear is what Washington’s ultimate objective is. Is it the reduction of the bilateral trade deficit? Is it the opening up of China’s economy? Is it to prevent China from achieving technological supremacy? While these objectives are not necessarily mutually incompatible, they are not necessarily compatible, either. Would the US accept Chinese technological dominance if it emerged in the context of a more open Chinese economy and less interventionist Chinese economic policies? Would the US accept continued large bilateral trade deficits even if China reduced trade barriers to US levels? It is far from clear that the modification of Chinese behavior or institutional changes to bilateral economic relations would lead to the outcomes sought by the US, whether they are to do with trade imbalances or technological leadership.

As long as there is a lack of clarity about US strategic objectives, it is not entirely clear which US policy measures vis-à-vis China will prove permanent and which will prove temporary. Tariffs and the threat of further tariffs may be a tactical measure to force China to the bargaining table or they may be regarded as more permanent measures to reduce the US trade deficit. (Whether tariffs will help achieve is doubtful from an economic perspective.) Or tariffs might be a more permanent feature of US policy towards China in an attempt to disrupt China-centred supply chains. Similarly, tighter US investment regulations and a revamped export control regime may be meant to help the US gain bargaining leverage. Or these measures may prove permanent in view of slowing Chinese technological progress. (In practice, these measures are bound to prove more permanent, not least because legislation puts certain limits on executive action, even if in practice the government does have some wiggle room.

Washington has sought to use China’s dependence on foreign trade as a pressure point to extract trade and other economic concessions from Beijing. China is more dependent on trade with the United States than vice versa. Moreover, the Chinese government depends more on economic growth as far as political stability is concerned than the US. This is not to suggest that US presidents faced with recurrent elections do not have a similar interest in economic growth. But for the Chinese leadership, the stakes are higher. A US president may be voted out of office. The Chinese government may be overthrown. The legitimacy of China’s political system, long based on communist ideology, today largely rests on a combination of generating economic progress and, increasingly, patriotism and nationalism. It is therefore imperative for Beijing to maintain support of the prospering middle and upper-middle class. If Beijing is looking for a reminder, how brittle regime stability is, it need look no further than Hong Kong.

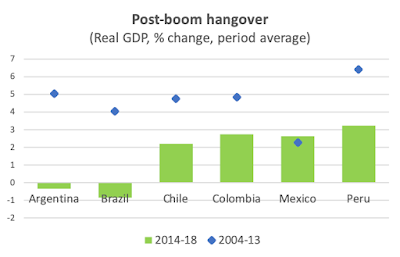

|

| Source; IMF |

While China is economically and – over the longer term – politically more susceptible to a disruption of foreign trade and its economic consequences, its ability to offset external economic pressure through domestic policy is greater than that of the US. Put differently, China is more sensitive to trade disruption than the US on account of its greater dependence on exports, but it also better positioned to deal with the economic headwinds from trade tensions than the US. Washington may (or may not) have correctly assessed China’s (economic) sensitivity. But it seems to have overestimated its (economic) vulnerability. It is beginning to look as if the present US administration has overplayed its hand.

China is more sensitive than the US in terms of foreign trade, but it is less sensitive than export figures suggest. First, while China’s gross goods exports – whether measured in terms of dollars, share of total exports or as a share of GDP – to the US are significantly larger than respective US exports to China, they overestimate China’s dependence on the US. The more relevant measure in terms of economic sensitivity is value-added exports. Given the large share of imported content embedded in Chinese exports, value-added exports to the US are significantly smaller than gross exports. Second, if services exports are added into the mix, China’s relative greater dependence looks even smaller. US services exports to China are considerable and the US runs a sizeable services surplus, compared to a large goods deficit. This makes the US relatively more sensitive than China (e.g. tourism). Third, and this is more significant from a political than an economic point of view, the sales of US subsidiaries in China are sizeable. If they were added to the bilateral trade in goods and services, the bilateral ‘trade balance’ would be almost balanced. Leaving aside the economics, the reliance of US companies on the Chinese market makes them sensitive to Chinese retaliatory measures (e.g. regulatory changes, tax inspections). This helps rebalance somewhat China’s greater political-economic susceptibility arising from China’s greater export dependence. Given the much smaller sales of Chinese subsidiaries in the US, this gives China greater opportunity to retaliate against the US economic interest than vice versa. (It is worth noting that if Washington’s ultimate objective is to get US companies to leave China altogether and/ or to disrupt global supply chains running through China, Beijing’s more hostile policy towards US companies in China would be playing right into Washington’s hands.) The long and short of it is that China is less vulnerable to US pressure than the focus on bilateral goods trade suggests, even if in the end China does remain economically and politically more sensitive than the US in case of a trade war.

|

| Source; WTO |

China is more sensitive than the US in terms of foreign trade, but its vulnerability (as opposed to sensitivity) is more limited due to its significant ability to offset some of the negative economic consequences due to US policies. This where

Keohane & Nye (1977). Sensitivity can be defined as how quickly changes in one country bring costly changes in another. Or less awkwardly: sensitivity captures the costs incurred by a state due to another state’s actions. Vulnerability captures the capacity of a state to counter and offset such costs by taking the appropriate measures. While China is more sensitive than the US in terms of trade tensions, its vulnerability is much more limited on account of its greater ability to offset the economic costs of US trade policies (and other economic measures). The US is relatively more vulnerable in the sense that its ability to counteract any costs through economic policies is much more limited. Taken together, this makes the ‘asymmetric interdependence’ between the US and China less asymmetric.

China has at its disposal important tools to mitigate the direct economic growth effects of hostile US trade policies. This is where

Katzenstein (1977) comes in handy, conceptually. China has a ‘strong’, centralised state that faces a ‘weak’ society. Moreover, China has important policy tools at its disposal to intervene in the economy. First, China has greater control over its financial system given the significant share of state-owned banks and/ or banks where the government remains an important shareholder. A combination of government ownership and regulatory influence (e.g. window guidance) allows a ‘strong’ Chinese state to pursue a counter-cyclical credit policy. Second, even though China has liberalised interest rates in recent years, the PBoC is not independent. Combined with window guidance, this allows the authorities to more directly influence domestic monetary and credit conditions. The PBoC is less likely to ‘push on a string’. Third, the Chinese authorities have significant control over fiscal policy, including quasi-fiscal policy. After all, the government does not rely on the approval of a politically independent legislative body to conduct fiscal policy. And while there is justifiable concern over Chinese contingent liabilities, especially at the provincial level, the central government can simply instruct other levels of government to crank up investment in order to stimulate the economy. Fourth, China also has far greater control over its exchange rate in spite of having move to a more market regime in the past few years. Restricted current account convertibility and significant influence over domestic banks give China greater influence over the value of its currency. (The Trump administration has of course noticed this leading it to designate China a currency manipulator.) Fifth, even though the Chinese regime is politically more sensitive to economic stability, it benefits from greater short-term political flexibility. The government (or regime) does need to run for (re) election and this gives it more leeway in terms of negotiating with the US, even it China’s structural political vulnerability is greater than that of US. In short, a higher degree of centralization, a statist political economy and the availability of important economic tools lessen China’s relative vulnerability as opposed to its sensitivity. As it happens, and US rhetoric notwithstanding, Chinese economic growth has suffered relatively little so far (

Lardy 2019).

By comparison, the US appears relatively more vulnerable. The US government has far fewer tools at its disposal to deal with the negative economic consequences (of its own trade policies). The US political system of government is more decentralized. Societal influence tends to have a greater influence on US economic policies, the political system is more fragmented ad the executive has fewer tools and controls fewer policy tools that would allow it to intervene in the economy. The US is less sensitive than China, but its ability to offset costs is more limited. First, the US government cannot simply decree credit growth. Second, unlike the PBoC, the Fed is independent and cannot be instructed to ease policies. The independence of the Fed reduces US bargaining power (and the president, correctly, seems to understand this). Third, the US government has much less flexibility in terms of switching on or off the fiscal taps, let alone conduct a quasi-fiscal policy. US states cannot be instructed by the federal government to increase fiscal spending or public investment, not to mention that they are generally constrained by balanced budget rules. And the federal government is arguably more constrained – both economically and politically – in terms of fiscal space and flexibility. Congress needs to sign off on major changes to fiscal policy. Fourth, the US has little influence over the value of the dollar given that exchange rate policy is legally vested in the Treasury, but the Fed is responsible for monetary policy. In the presence of an open capital account, this, for all practical purposes, circumscribes the ability of US policymakers to determine the value of the dollar. They can of course seek to influence it indirectly, but this is typically not very effective. Fifth, while the US is arguably less dependent on economic growth as far as political instability is concerned, US governments/ presidents are held to account every four years and, one might argue, every two years in the mid-term elections, whose outcomes matters greatly to the president’s political standing. Economic conditions are typically a very important factor in determining US elections. Short-termist political concern limit the willingness of the US government to incur economic costs in view of longer-term economics gains. In other words, the incentives to escalate US-China tensions to the point where it slows the US growth – whether due to the direct impact of tariffs or the indirect impact of tariffs on market confidence – not only limits the flexibility of US policies, it also makes threats to escalate further somewhat less credible.

Differences in terms of state strength may also help explain why US policy towards China appears somewhat less consistent than China’s policy towards the US. US policy may be more subject to short-term tactical concerns (see presidential tweets) rather than the outcome of a long-term strategy. China, by comparison, should be able to take a longer-term view given the lesser degree of short-term accountability. China is often said to take a long-term view of things. This is often attributed to China’s strategic culture or national character. The most famous anecdote has China’s foreign minister, Zhou Enlai, respond, when asked in the 1971 what he thought about the French revolution: it is too early to tell. (It has recently been suggested that Zhou Enlai believed that the question referred to the 1968 student protests in France rather than the French Revolution in 1789. Lesson: never let facts stand in the way of a good story. Be that as it may, the inclination to adopt a longer-term view may or may not be rooted in culture, but the ability to do so is almost certainty attributable to a domestic political structure that is fairly centralized and can afford a certain degree of lack of short-term responsiveness to societal demands. This provides a distinct advantage to China in its present negotiations with the US.

China in spite of its relatively greater economic sensitivity looks much less vulnerable to US economic pressure once state strength is factored into analysis – at least in the short- to medium-term. How about the longer term? The US political regime less likely to experience severe instability or a breakdown, while China’s political regime looks comparatively fragile. After all, if China goes the way of other East Asian countries in terms of economic development, social modernization and democratization, the Chinese regime must feel vulnerable. In the short term, China has a significant capacity to offset foreign economic pressure, while the US government is much more constrained. In the longer term, the Chinese political system looks distinctly less well-positioned in terms stability than the US if it fails to safeguard economic prosperity. (Of course, continued economic progress is likely set to increase the pressure on China’s political system in terms of political liberalisation. But that’s another story.

Fundamentally, China’s political regime is characterized by ‘fragility’, while the US, in spite of its present domestic constitutional and political challenges, exhibits – arguably – robustness,if not necessarily anti-fragility. If you are looking for a good read about what might go wrong in the US and why my prediction may turn out to be wrong, I recommend

Ziblatt & Levitsky's How Democracies Die (2018). Many years ago, a chance acquaintance of mine, who had studied at Cambridge in the 1930s, told me that back then his professor had compared Britain’s democracy to a raft: it may be occasionally dip under water in stormy seas, but it will stay afloat. By contrast, the fascist and communist regimes of the day were more like huge ocean liners, massive and powerful and indestructible (looking). However, if they hit an iceberg, they will sink, while the raft will remain afloat. The analogy turned out to be apt. This is not meant to suggest that China’s political regime is fascist, let alone communist in the sense resembling the regimes of the 1930s. But it is to suggest that China’s more monolithic and centralized political regime is ultimately more fragile that US democracy. It may look solid, but when sufficiently shocked, it may break quickly break. In metaphysics, fragility is a dispositional term.

What does all of this suggest for the future of the China-US economic conflict? Regardless of Washington’s ultimate objectives, US diplomacy will probably need to reduce its ‘asks’ if it wants to reach an agreement with Beijing. To the extent that protectionist measures weigh on US economic growth and risk tipping the US into recession, a further escalation will lack credibility, not least because Beijing has important policy levers at its disposal to counteract the short-term negative consequences of more hostile US policies. This does not mean that China would not be prepared to sign up to an agreement around intellectual property rights safeguards, a reduction of the bilateral trade imbalance through increased Chinese purchases and a further opening of the Chinese economy in exchange for an end to US tariffs. But Beijing will be extremely reluctant to agree to a significant revamp of its domestic political economy, especially if such a reform were to decrease China’s future ability to deal with external pressure and exogenous shocks as well as its ability to catch up with US economically and technologically. Put differently, a fundamental reform of the political economy that might weaken government control of the economy, thereby leading to an increase in its vulnerability, is very unlikely. Such a reform would almost certainly weaken – or be seen to weaken by Chinese policymakers – China’s ability to catch up (and maybe overtake) the US in economic and technological terms. A failure to do so would prolong China’s sensitivity to US pressure in the context of a bilateral relationship that is bound to become more contentious over time, both economically and politically (e.g. security competition in East Asia). If this analysis is correct, the US will find it difficult to credibly threaten a broader escalation of trade and economic tensions and China will resist making changes to its domestic political economy that would prevent it from lessening its sensitivity and might even increase its vulnerability to US policies against the backdrop of an

emerging strategic rivalry. True, US policy measures such as export controls and investment restrictions are bound to have a significant impact on China’s longer-term economic growth.

China will not be prepared to dismantle its economic model in exchange for a (in practice) revocable US promise to reduce export controls and inward investment restrictions, either. As long as China believes that it can only compete with, or outcompete, the US with the help of interventionist economic policies and as long as China believes that the US is prepared to politicise bilateral economic relations, as it surely is, Beijing has next to no incentive to abandon the very development model, including industrial policies, that would help make it less dependent on the US over the longer term. In addition, Beijing’s recognition of the fragility of its political system will provide Beijing with a significant additional incentive to intensify its efforts to reduce its sensitivity to US actions, while retaining sufficient to keep its vulnerability to a minimum. Washington's ‘weaponisation’ of (asymmetric!) economic interdependence may lead Beijing to reach out to other large, advanced economies in an attempt to manage its continued dependence on the US – whether the dependence concerns trade, supply chains, dependence on US export markets, the dollar, critical technology etc. At the same times, Beijing will likely to intensify efforts to make itself less dependent on the US, economically and technologically, rather than increase its sensitivity and vulnerability in the wake of a 'deal' with the US. As long as Beijing believes that its domestic political economy is key to catching up with the US as well as crucial to mitigating present and future US pressure, it is not going to make any modifications to it that might increase its sensitivity and vulnerability.

If Washington's strategic objective is to prevent China from becoming a technological leader rather than create a 'fairer' and more 'balanced' economic relationship with China, then demanding wide-ranging changes to China's political economy makes sense. Either Beijing gives up its support for SOEs and China 2025 or it will be forced into increasing isolation from the US economy in terms of trade, investment and technology. Moreover, US demands for fundamental changes to China's political economy regime may lead China itself to make the conscious decision to limit its susceptibility to US economic power by pursuing more inward-looking economic development policies. Washington might well prefer for China to abandon its state-interventionist policies. But if this cannot be achieved, then slowing China's economic and technological advance by disruption supply and limiting China's access to US markets and US technology, while giving Beijing incentives to further reduce its present sensitivity and vulnerability to disruptive US policies, would constitute a second-best outcome from Washington's perspective.