- A transatlantic defensive economic security alliance would be well-positioned to deter third-party geo-economic aggression. The alliance should commit its members to providing economic assistance as well as coordinate retaliatory policies in case of geo-economic coercion targeting any of its members. (A geo-economic attack is defined as geopolitically motivated discriminatory economic measures.)

- Alliance policies should combine ‘deterrence by denial,’ such as creating shared reserves of critical goods and a jointly financed fund to mitigate the economic effects of third-party coercion, with ‘deterrence by punishment,’ such as retaliatory trade and financial measures

- It is imperative to define the conditions under which mutual economic assistance and joint retaliatory policies are triggered in order to avoid ‘entrapment’ and limit the risk of geo-economic conflict. If deterrence is successful, it will help stabilize international economic relations, provided alliance policies are designed to discourage offensive geo-economic action by its members

The EU and the United States should create a defensive economic security alliance to deal with the ‘economic security dilemma’ in the context of the recent trend toward the weaponization of international economic relations. Such an alliance would harness the aggregate economic, financial and technological power of its members to deter third-party geo-economic (geopolitically-motivated) coercion. If deterrence proves successful, it will help strengthen the multilateral international economic system. If it fails, it may yet help limit the vulnerability of the alliance and its members to geo-economic coercion.

In light of recent transatlantic disagreements, fostering closer economic security cooperation may look like wishful thinking. Moreover, the EU-US Trade and Technology Council, which seeks to address some economic security issues, seems to have made little progress so far, despite eighteen months of talks. However, the United States and Europe do share broadly similar economic interests in terms of supply chain security and access to critical goods. Their economies are highly interdependent in terms of trade and investment. The existence of a transatlantic security alliance also facilitates economic cooperation, including cooperation on economic security, due to its favorable security externalities.

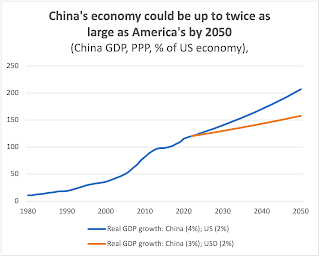

But the United States and Europe also diverge in terms of their willingness to pursue offensive geo-economic policies, particularly vis-à-vis China. Washington is less dependent on China economically, and it is more directly affected by Beijing’s military rise, given its extensive security commitments in Asia. By contrast, Europe would rather avoid getting embroiled in US-China geo-economic conflict – if it can help it. Either way, Washington is not going to let itself by constrained by a transatlantic economic security regime.

To address the risk of ‘entrapment’ it will therefore be necessary to define as clearly and unambiguously as possible what constitutes ‘unprovoked’ third-party geo-economic coercion as well as what constitutes third-party retaliation that is taken in response to geo-economically offensive measures. In the latter case, alliance members should have the right to invoke an exemption in terms of providing support to limit the risk of entrapment as well as to restrain offensive policies by alliance members. This would allow the United States to continue to pursue its hawkish strategy vis-à-vis Beijing without entrapping the alliance. Nevertheless, alliance membership would benefit Washington by shoring up economic security within the transatlantic security alliance and by strengthening deterrence in case of ‘unprovoked’ third-party aggression.

Elements of Successful Geo-Economic Deterrence

The literature on coercion distinguishes between deterrence and compellence.[1] Compellence (forcing an actor to take a specified action) is generally less successful than deterrence (dissuading an actor from taking a specified action), which is why economic sanctions are typically inefficacious in terms of their political objective, particularly when they target a geopolitical adversary.[2] Another important distinction concerns deterrence by punishment and deterrence by denial. The former threatens to impose costs on a coercer by way of retaliation; the latter seeks to deny the coercer its political objective by limiting one’s economic vulnerability. [3]

Following Jentleson, two sets of factors are important in designing successful deterrence policies: the defending state’s deterrence policies need to be characterized by proportionality, reciprocity, and credibility, and they should take advantage of the attacking state's economic-political vulnerabilities, thereby making policies more effective. [4] In the context of geo-economic deterrence, mitigating one’s own vulnerabilities vis-à-vis a potential coercers also increases the likelihood of successful deterrence (by denial).

Proportionality means that the defending state’s objective must be commensurable with its available policy options. A threatened response that is extremely disproportional, whether too weak or too strong, will not be sufficiently credible. (However, in case a state possesses escalation dominance, threatening more than proportional retaliation can be desirable.) Reciprocity requires an unambiguous common understanding of the link between the aggressor’s actions and the deterrer’s response. It is imperative to make a coercer aware that aggression will elicit retaliation, not least in order to minimize the risk of misperception. Credibility requires threats to be sufficiently believable for the aggressor to expect that the threatened retaliatory response will materialize. In this context, deterrence is more credible in case the deterrer possesses ‘escalation dominance.’ But escalation dominance is not necessarily required for deterrence to be successful, nor does it guarantee its success. But it enhances its credibility and therefore its chances of success.

Deterrence Policies and Alliance Politics

Deterrence can and does fail. Deterrence is ultimately about psychology not material advantage. It is not exclusively determined by the balance of economic costs and benefits. It is determined by how highly motivated deterrer and the coercer are. Nevertheless, well-designed policies will make deterrent success more likely. Designing effective and credible policies is even more of challenge in the context of alliances. In alliances, the risk of entrapment (being drawn into a conflict) and abandonment (not receiving alliance support in case of third-party aggression) is ever present, which risks undermining both credibility and effectiveness. Designing geo-economic deterrence policies in the context of a transatlantic economic security alliance should hence take into account the following criteria:

1. Define as unambiguously as possible what constitutes third-party geo-economic coercion and what trigger the obligation of alliance members to assist and retaliate. Not all discriminatory measures rise to the level of geo-economic (geopolitically motivated) coercion.

2. Agree on well-defined thresholds that trigger mitigating or retaliatory actions. If the threshold is too low, the risk of geo-economic coercion will be high. If the threshold is too high, deterrence will become less effective.

3. If intra-alliance disagreement over whether a third-party action constitutes coercion emerges, it may make sense to introduce balance entrapment and abandonment by opting for (defensive) mitigating rather than (offensive) retaliatory measures in case the alliance fails to reach agreement. The introduction of different majority thresholds might also be considered, which can help mitigate entrapment and abandonment risks.

4. Design obligations and policies in such a way as to minimize entrapment. This can be done by limiting or even waiving mutual assistance and joint retaliation obligations in case third-party action is a response to prior ‘offensive’ action by an alliance member. Not only is it imperative to define precisely what constitutes third-party coercion, but it is similarly important to define what constitute offensive geo-economic policies on the part of alliance members vis-à-vis a third party. (This will be tricky, but only because it is tricky does not mean that it cannot be done.)

5. Communicate clearly to would-be coercers that geopolitically-motivated discriminatory economic measures may provoke a retaliatory response without laying out in detail what this retaliation will consist of. This is meant to limit the coercer’s ability take preemptive defensive measures.

6. Devise effective and credible and proportionate joint retaliatory responses targeting coercers. Policies should target the aggressor’s politically salient economic vulnerabilities, while limiting the costs to the alliance in aggregate and individually

7. Deterrence policies should be based on the threat of ‘in-kind retaliation,’ emphasizing the link between an aggressor’s actions and retaliatory measures. But if the alliance does not possess ‘escalation dominance’ in a specific area and cannot credibly and effective threaten retaliation, horizontal economic-financial escalation should remain on the table. The threat of horizontal escalation should be communicated as such.

8. Seek a somewhat equitable intra-alliance distribution of the costs of both mitigation and retaliation policies (‘burden-sharing’). The costs of joint mitigation measures, such a acquiring reserves of critical goods or acting as a ‘buyer-of-last-resort’ in case of import restrictions, should reflect economic size, per capita income and country-specific vulnerabilities. Countries with a greater vulnerability should contribute more by making a greater contribution, relative to their economic size and per capita income. A similar mechanism should be devised in terms of retaliatory policies to ensure that their costs do not fall disproportionately on only one or a handful of alliance members. Aligning costs and benefits will limit the incentive for the ‘weak to exploit the strong,’ which will help enhance alliance credibility.

9. Alliance members should also commit, individually and jointly, to limiting single-country economic and financial risk exposure in order to weaken third-party coercive power. This would help strengthen deterrence by denial and it would reduce the need for retaliatory policies.

Transatlantic Economic Deterrence Policies

At a minimum, the defensive alliance policies should comprise the following:

- Mitigate effect of third-party import restrictions. Reach an agreement to purchase goods affected by import restrictions to mitigate their economic impact (deterrence by denial). Consider providing other types of economic or financial support to mitigate the impact of coercive measures.

- Deter third-party import restrictions. Threaten to retaliate against import restrictions introduced by a third-party aggressor through the imposition of alliance-wide, retaliatory restrictions. If this is impractical due to a high degree of dependence on the coercer’s exports, devise more elaborate schemes, such as price caps or a buyers’ cartel (deterrence by punishment).

- Mitigate the effects of third-party export controls by creating jointly financed reserves of critical goods and by putting in place an equitable access agreements. This should help mitigate concomitant vulnerabilities and potential costs, thus reducing the coercer’s geo-economic leverage (deterrence by denial).

- Deter third-party export restrictions by threatening to impose retaliatory export control measures targeting a third-party coercer’s economic-political vulnerabilities. In addition, establish a compensation mechanism so that the costs of export controls are shared more equitably among alliance members rather than have them fall on only the countries producing the restricted good (deterrence by punishment)

- Deter the imposition of discriminatory financial measures, such as asset freezes, expropriation and other (politically-motivated) financial restrictions, by threatening financial retaliation, including restrictions on the use of the dollar and the euro.

[1] Thomas Schelling, The strategy of conflict (Cambridge 1960)

[2] Clyde Hufbauer, Jeffrey Schott and Kimberly Ann Elliott, Economic sanctions reconsidered (Washington 2009)

[3] Deterrence by denial is more WTO compatible than deterrence by punishment.

[4] Bruce Jentleson, Sanctions (Oxford 2022)